Certainly, here are 15 points discussing the pros and 15 points discussing the cons of using Fibonacci retracement in trading:

The Power of Fibonacci Retracement in Trading – Pros:

- Price Prediction: Fibonacci retracement helps traders predict potential future price levels based on historical price movements.

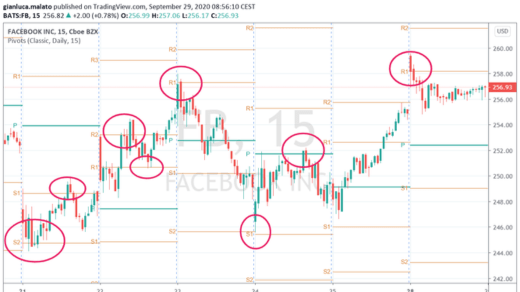

- Objective Tool: It provides a systematic and objective way to identify support and resistance levels.

- Universal Applicability: Fibonacci retracement can be applied to various asset classes, including stocks, forex, and cryptocurrencies.

- Visual Clarity: The tool is visually clear, making it accessible even for novice traders.

- Historical Significance: Fibonacci numbers have historical significance in nature and mathematics, adding to their appeal.

- Confirmation: Fibonacci retracement levels can confirm other technical analysis signals.

- Popular Tool: Many traders use Fibonacci retracement, which can create self-fulfilling prophecies.

- Retracement Zones: It identifies potential retracement zones where price corrections may end.

- Risk Management: Fibonacci levels can help traders set stop-loss and take-profit orders more effectively.

- Trend Confirmation: Fibonacci retracement can confirm the strength and validity of a prevailing trend.

- Long-Term Analysis: It can be applied to both short-term and long-term trading and investing.

- Multiple Timeframes: Traders can use Fibonacci retracement on various timeframes for confirmation.

- Extension Levels: Fibonacci extension levels can provide potential price targets for trend continuation.

- Price Harmony: Some traders believe that Fibonacci levels represent price harmonics in the market.

- Confluence of Levels: When multiple Fibonacci retracement levels align with other technical factors, it can strengthen the analysis.

The Power of Fibonacci Retracement in Trading – Cons:

- Subjective Interpretation: Traders may interpret Fibonacci levels differently, leading to varied trading decisions.

- Over-Reliance: Relying solely on Fibonacci retracement without considering other factors can be risky.

- Lack of Certainty: Fibonacci retracement levels are not guaranteed to hold, and price can break through them.

- Market Noise: In noisy or choppy markets, Fibonacci levels may not provide clear support and resistance.

- Emotional Decision-Making: Traders may become emotionally attached to Fibonacci levels, leading to biased decisions.

- Lack of Predictive Value: Fibonacci retracement does not predict future price movements with certainty.

- Complex Corrections: Complex market corrections can make it challenging to identify valid retracement levels.

- False Signals: Not all retracement levels lead to significant price reactions.

- Interference with Other Tools: Overlapping Fibonacci retracement levels can create confusion when used with other technical indicators.

- Discretionary Nature: Traders may use different swing points for drawing Fibonacci retracement levels, leading to discrepancies.

- Market Sentiment: Market sentiment and news events can override Fibonacci retracement levels.

- Lagging Indicator: Fibonacci retracement is a lagging indicator, as it relies on past price data.

- Not Foolproof: Relying solely on Fibonacci levels without risk management and other analysis is not foolproof.

- Complex Calculation: Some traders find the calculation of Fibonacci retracement levels complex.

- False Breakouts: Price can temporarily break past a Fibonacci level before reversing.

In summary, Fibonacci retracement is a powerful tool in trading that can help identify potential support and resistance levels. However, it is not foolproof and should be used in conjunction with other technical analysis tools and risk management strategies. Traders should also be aware of its subjective nature and the possibility of false signals in certain market conditions.